With banks and credit unions across the country adapting to the ‘new normal,’ Austin-based Q2’s mission to help them provide seamless digital banking experiences has never been more important.

Q2 powers online banking portals and mobile apps that bring hundreds of community financial institutions to digital parity with massive national banks. Historically, about 50% of bank customers visit digital banking applications. But during the crisis, that percentage has spiked, at times stressing the systems and requiring quick action and communication from the Q2 team.

Long a Pendo customer, Q2 turned to its Pendo dashboards to make sense of changes in usage and to launch an in-app messaging campaign. This helped banks adapt to swiftly changing circumstances and ensured Q2 could continue providing high-touch service to their customers.

„Zu den Dingen, die wir festgestellt haben, gehört, dass die Kunden unserer Kunden der Herausforderung gegenüberstehen, wie sie ihre Bankgeschäfte jetzt erledigen“, sagt Michael Vasquez, Produktverantwortlicher bei Q2. „Ein Produkt wie Pendo zu haben, das ihnen Schritt für Schritt dabei hilft, dies herauszufinden – unsere Kunden haben um eine solche Erfahrung gebettelt."

At first, the jump in usage that caused an outage appeared to be a potential distributed denial of service attack. But, using Pendo’s analytics, Vasquez quickly diagnosed the true cause: a surge in users trying to log in—double the amount normally seen on a Monday.

Michael Vasquez konnte die Ursache ermitteln, indem er die Nutzung der Anmeldeseite, der zu ladenden Seiten und Startseiten der Banken und Genossenschaftsbanken auf den wichtigsten Web- und Mobilanwendungen von Q2 untersuchte. Wie sich herausstellte, war der Montag mit erhöhter Aktivität auch der Tag, an dem die staatlichen Konjunkturpaket-Schecks auf den Bankkonten von Millionen von Amerikanern gutgeschrieben wurden. Alle wollten wissen, ob ihr Scheck angekommen war.

Es war kein Cyberangriff, wie einige bei Q2 befürchtet hatten – stattdessen war es eine Lawine von Kontoinhaber-Aktivitäten. Nachdem das Problem identifiziert worden war, konnte die IT den Kunden, die die größten Anstürme erlebt hatten, Kapazitäten hinzufügen, um sicherzustellen, dass Q2 einen Wiederholungsfall abfangen würde.

Covid-19 has forced many of the financial institutions that Q2 serves to accelerate their digital transformation initiatives—or for others, launch them from scratch. For many of their account holders, it represented their first digital banking experiences.

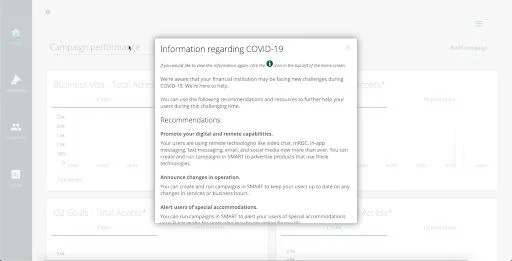

Early in the crisis, Pendo helped Q2 quickly communicate with banks in-app. Vasquez and his team deployed guides across Q2’s various apps, delivering information about virus-related changes and advice for financial institutions that found themselves suddenly navigating a new business landscape.

When businesses came to Q2’s customers seeking loans under the stimulus bill and were forced to carry out the whole process virtually, Vasquez and the Q2 team were able to use Pendo tooltip guides to walk users through digital loan applications, providing information about fields that many found confusing. What’s more, it was completed quickly — without requiring a line of code to be written.

Ein Tool wie Pendo zur Identifizierung von Aufgaben oder Workflows, die Verwirrung oder Frustration der Kunden verursachen und sie bei der Erfahrung zu begleiten, erhöht laut Michael Vasquez erheblich die Chancen einer erfolgreichen digitalen Transformation für die Kunden von Q2.

Q2 was able to adapt so quickly to the Covid-19 crisis thanks to a years-long investment in Pendo. The company originally brought the tool in for its analytics capabilities, vetting Pendo along with Mixpanel, Kissmetrics, Google Analytics, AppDynamics, and Heap. But Pendo’s retroactive analytics, the ability to use that data to segment and target users, and ease of designing guides without engineering help were the deciding factors in Q2’s selection.

Pendo’s in-app messaging and guidance capabilities made adding self-service support and onboarding new users with walkthroughs and tooltips simple for Vasquez’s team. In one case, a simple tooltip explaining the difference between a user’s “current balance” and their “available balance” was viewed 3,000 times and effectively eliminated one of the most commonly submitted support tickets.

„Die Möglichkeit, diesen Tool-Tipp zu installieren und das in 10 bis 15 Minuten, spielte eine unglaublich wichtig Rolle für sie“, sagt Michael Vasquez.

Now, Q2 is using Pendo to offer its customers the ability to see their own usage analytics for their instance of Q2 and deploy in-app messaging to their own customers in a white-labeled instance. Vasquez and his team plan to start rolling Pendo out in other Q2 products soon.