From “traditional” to trailblazer: How non-tech companies are forging ahead with digital transformation Europe 2023

Zum Lesen scrollen

Inhaltsverzeichnis

In a rush? Download the PDF for later

Download the BerichtIntroduction: When tech’s loss is “traditional” companies’ gain

If you work in tech, chances are the prospect of layoffs isn’t just something you see far off in the headlines. Industry wide, tech companies have responded to growing macroeconomic pressure by parting ways with large amounts of talent. Between March 2022 and 2023 alone, startups in Europe cut 40,000 jobs.

At the same time, nothing happens in a vacuum. Right when tech companies are tamping down their workforces, businesses long regarded as “traditional” are racing to scoop up the talent. A new global study from Pendo and Product Collective finds that product management teams—a function typically prevalent in technology companies—have grown in size by 9% in traditional enterprises globally over the past two years. What’s more, they’re expected to continue growing at the same rate.

What explains this rush to hire tech talent? Why the focus on product management at say, a consumer goods manufacturer, airline, or insurance company? (Hint: It’s got nothing to do with product teams for product teams’ sake.) At a high level, the answer is simple: These teams strengthen the business and its bottom line.

Product teams are increasingly important to the organization as a whole. What started as an engineering-adjacent role centered on shipping new software features has evolved into a strategic role for the business. Product teams today distill inputs from customers, internal stakeholders, and the market in order to identify the right products or features for a company to build in order to grow and maintain their customer base. In essence, product management teams tie their efforts to revenue and customer retention. With the pressure to find new ways to do more with less in the face of a looming recession, it’s an opportunity too important for companies to pass up.

What’s more, this is just one of the many ways traditional companies are adopting tools, strategies, and tactics traditionally used by technology companies to efficiently scale and drive innovation and growth. In the report that follows, we’ll be examining other developments that blur the line between what constitutes a “traditional” company vs. a technology company, and zooming in on what change looks like for Europe in particular.

Methodology:

Pendo and Product Collective partnered with a third-party agency in April and May 2023 to conduct a global survey of more than 1,200 non-tech companies with 500 or more employees across the U.S. and Europe. The goal was to gauge the extent to which traditional businesses are acquiring the talent, tools, and strategies typically used by technology companies as they undergo digital transformation.

Key findings:

I. Efficiency remains the name of the game in Europe

In the face of a persistently sluggish global economy, what matters most to traditional companies based in Europe has been and continues to be efficiency. Two years ago, the No. 1 R&D priority for traditional companies in Europe was efficiency. In 2023, that remains the case.

Priorities for companies in Europe in 2023

This is not to say that what businesses consider most important is uniform globally. Looked at in isolation, for example, the U.S. has launching new products and innovation as its top two priorities.

In Europe, however, the pattern is clear: Until the macro climate improves, companies will find ways to do more with less. In other words, efficiency is the name of the game.

II. Germany leads the way in Europe for companies embracing a tech mindset

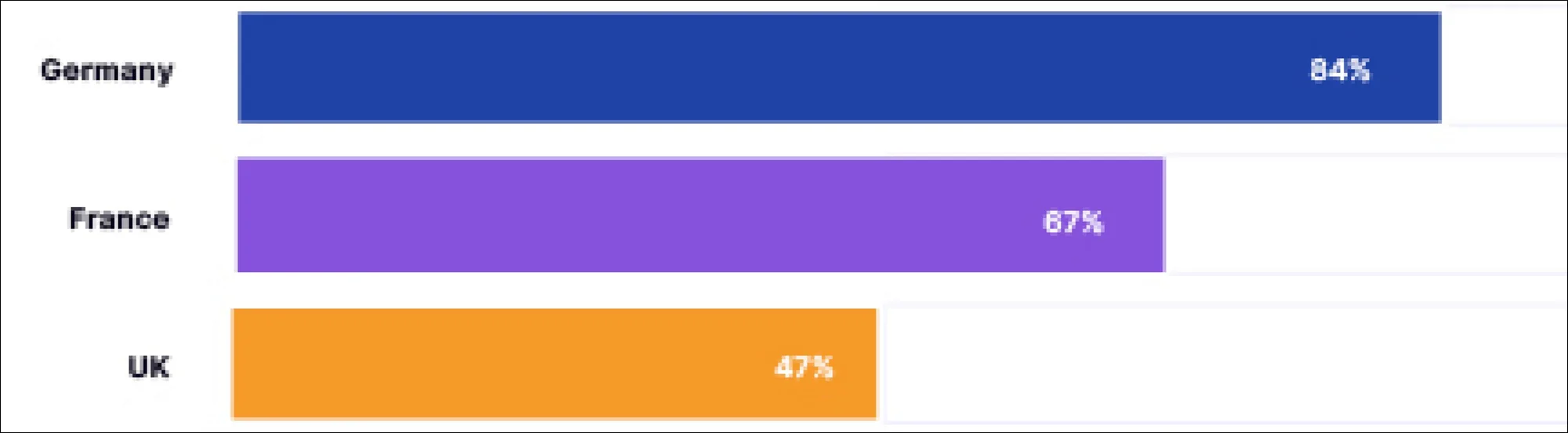

As traditional companies look and act more like tech companies, it’s important to remember that the change is deliberate. Two thirds of traditional enterprises in Europe (66%) now see themselves as technology companies today.

Do European “traditional” enterprise companies see themselves as tech companies?

While this number pales in comparison to traditional companies in the U.S. – of which an astonishing 96% consider themselves tech companies – it also masks some notable differences between European countries.

Consider that in the United Kingdom, less than half (47%) of traditional companies consider themselves as technology orgs. In France, the number jumps to over two thirds (67%). But the clear European leader here is Germany, where 84% of traditional companies see themselves as tech ones.

Who’s responsible for this shift in mindset? Globally, an equal percentage of respondents (48% in both cases) say company leadership vs. on the ground teams, indicating that change is a company-wide effort.

III. Traditional companies have been investing in the right tech and tools for their R&D teams—and it’s paying off

Embracing shifts in business strategy and tactics usually requires investment in new tools. In this case, traditional companies are rallying behind product analytics, recognizing its importance not only to product teams but to the organization as a whole. These tools not only provide product teams helpful data on things like feature adoption and usage, they also provide vital metrics pertinent to overall business health, including KPIs that correspond to customer satisfaction and likelihood of retention vs. churn.

As noted above, efficiency continues to be the No. 1 R&D priority for traditional enterprises in Europe, and their investment in product analytics reflects that. A full 83% of European respondents say that product data and analytics are increasing efficiency when building products. And product teams specifically have seen a positive or somewhat positive effect on product development from implementing product analytics tools (60%).

IV. Traditional companies are also investing in the right people—and it’s paying off

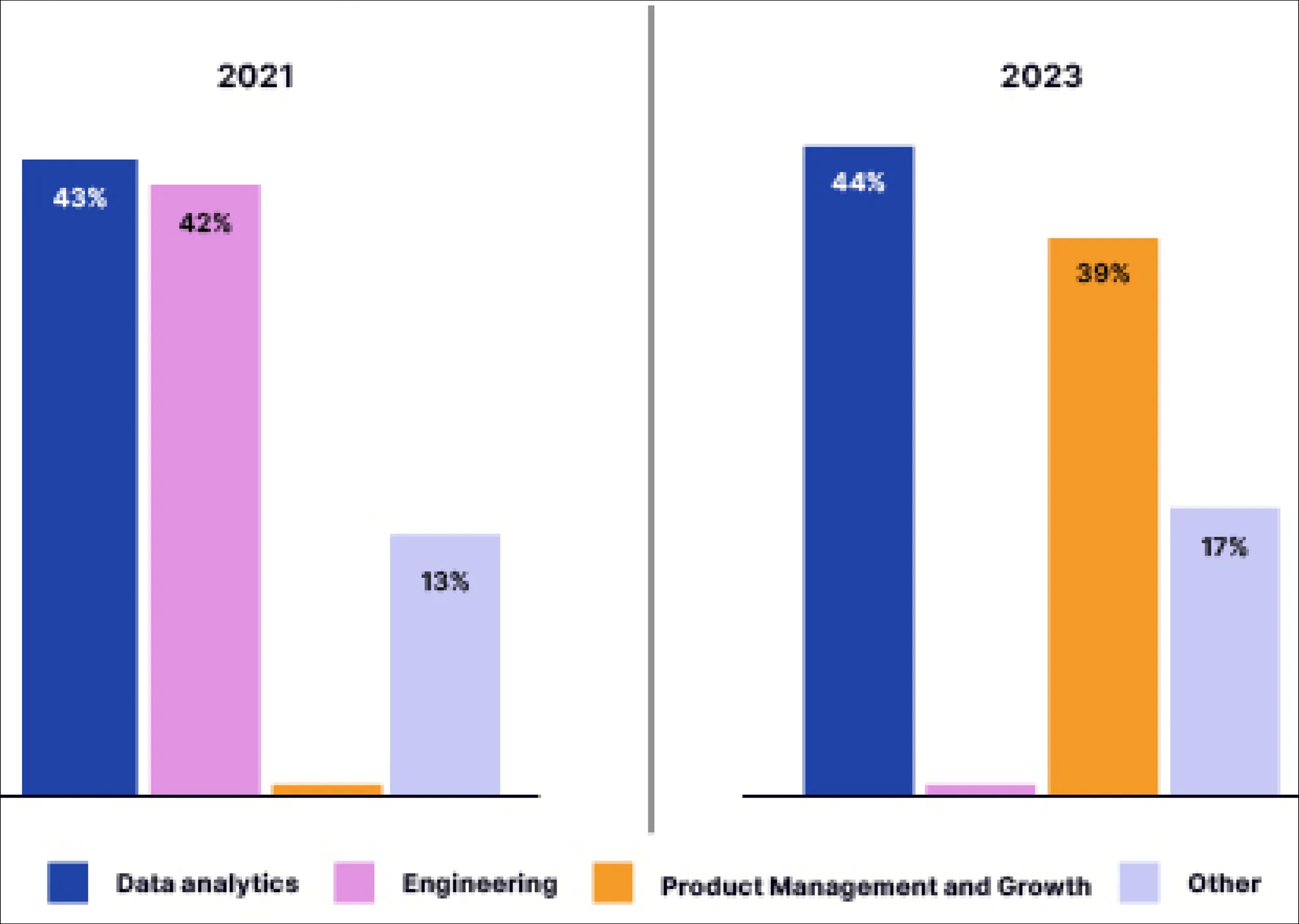

We’ve already seen how traditional enterprises are swooping in to recruit top tech talent as they pivot their business strategies to look more like those of tech companies. Traditional companies’ product teams have grown 9% since 2021 globally, and within that space, there’s an emerging consensus about which specific roles are most needed.

Role priorities for 2021 vs. 2023

Two years ago, most product teams in traditional companies in Europe were focused on hiring either software engineering (47%) or data analytics (44%) as their top priorities to meet business goals. Fast forward to today, and while almost half of teams (43%) now say that data analytics roles are most important, the second most common response has become product management and growth roles (39%). And with the increasingly vital role PMs play in driving customer growth and combating churn, it’s not hard to understand why.

V. There’s a huge expectations gap across roles and regions when it comes to AI

The consensus among traditional enterprise product teams is that data and analytics skills are what’s most needed. These are areas where emerging AI technology can perform and assist humans effectively.

And yet there is a massive expectations gap around the potential for AI, with company leadership twice as likely to prioritise AI/ML skills than their reports. Nearly half of company leaders (44%) rank AI/ML skills as most needed to achieve business goals, while just 19% of contributors overall believe those skills should be prioritised.

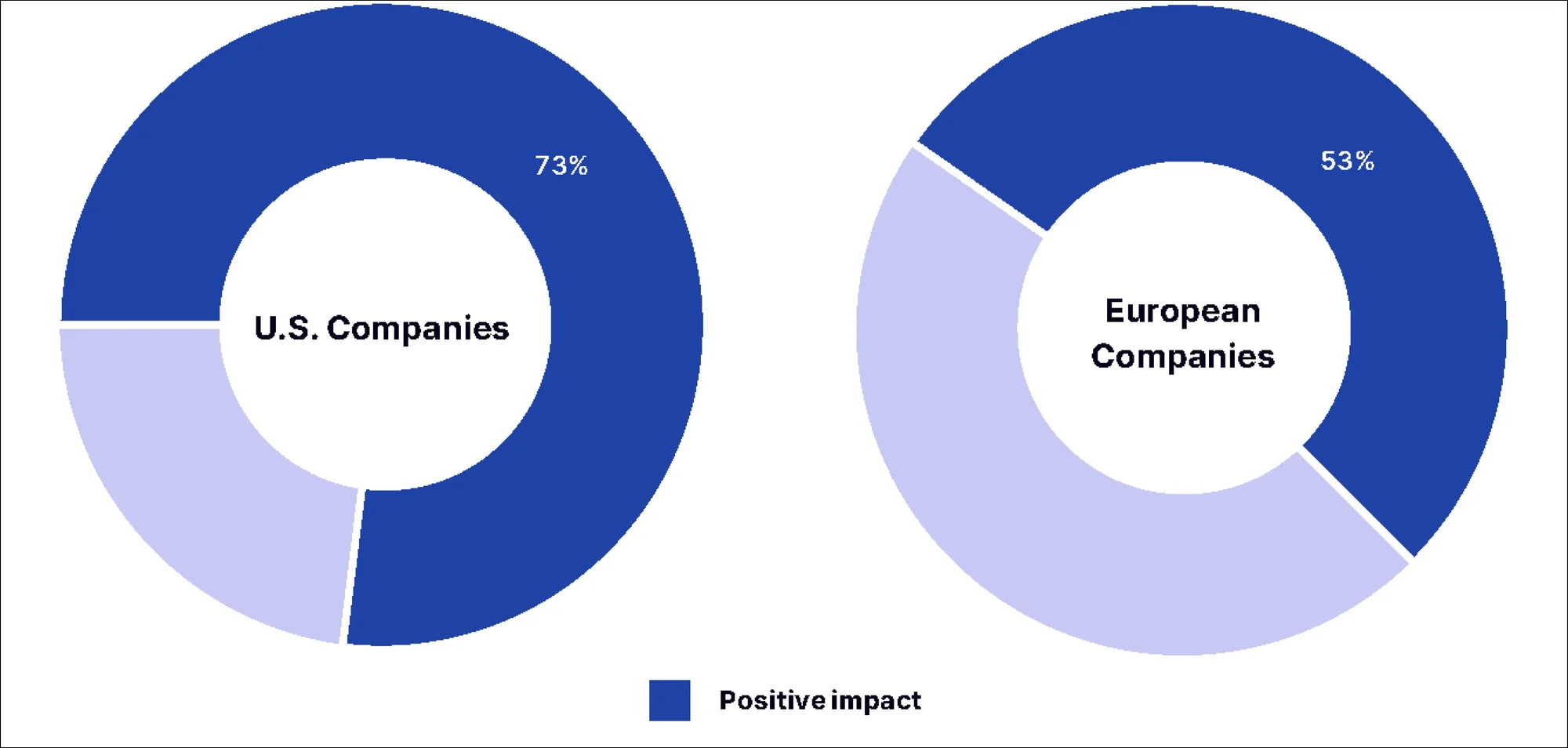

Here the U.S. is clearly outpacing Europe in both adoption and value realization: U.S. companies seem to see much more value from implementing AI/ML technology, with 77% of teams based there reporting a positive impact from leveraging it. In contrast only 53% of European companies are seeing a positive or somewhat positive effect.

Impact of leveraging AI/ML technology in U.S. vs. Europe

Conclusion: From “traditional” to tech

The fact that traditional enterprises are looking and behaving more like tech companies gets at a core truth about the business world today: No matter what product you build or sell, you’re selling to increasingly tech-savvy consumers who engage with your business and product via digital experiences.

Tech companies may have been the first to put their product and product teams at the center of their business model, but as the findings here show, “product-led growth” is becoming more and more synonymous with “business growth” as a whole.

Want to learn more about how Pendo helps enterprises implement the best product-led strategies and tactics, regardless of industry? Take a self-guided tour or schedule a custom demo.