Inhaltsverzeichnis

In a rush?

Download the PDF for later

Executive summary

Inflation is up. Revenues are down. Budgets and headcount are frozen or shrinking. These are just some of the complex challenges an economic downturn poses to companies looking to successfully navigate the future. But there’s a silver lining. In meeting these challenges, organizations are forced to narrow their focus. They’re building for a better tomorrow by investing in their biggest opportunity. But what is that exactly?

In a word: their product. In a recent survey, Pendo and Mind the Product asked over 500 product professionals how their work and their companies’ priorities have changed in response to current economic conditions. What we found was a growing recognition of the importance of product and the people responsible for product. We also saw the majority of respondents say they feel supported and empowered by their organizations, even as they worry about the staffing challenges the economic downturn has brought with it. Finally, the survey shows that businesses are rapidly embracing product-led growth (PLG) tactics as part of their greater strategy.

The results are clear: Product teams and the work they do are more important to overall business health than ever before.

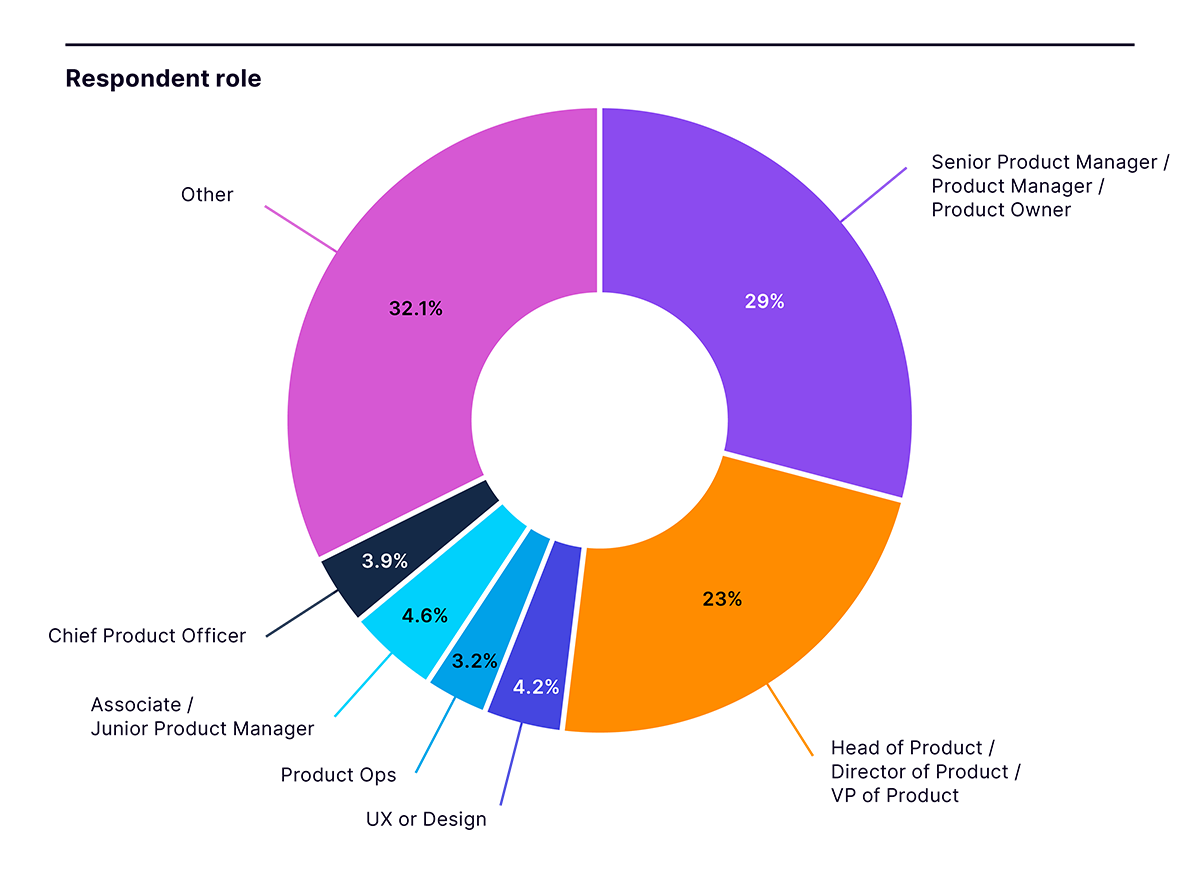

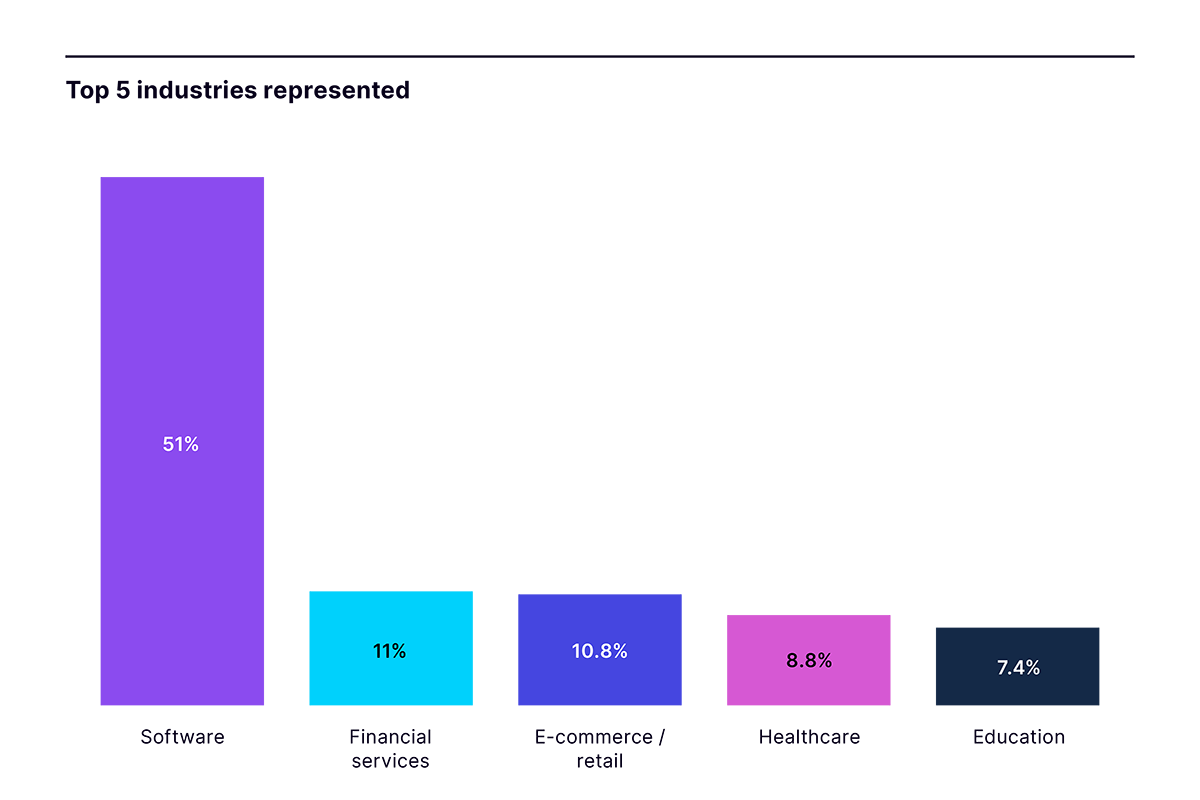

Methodology

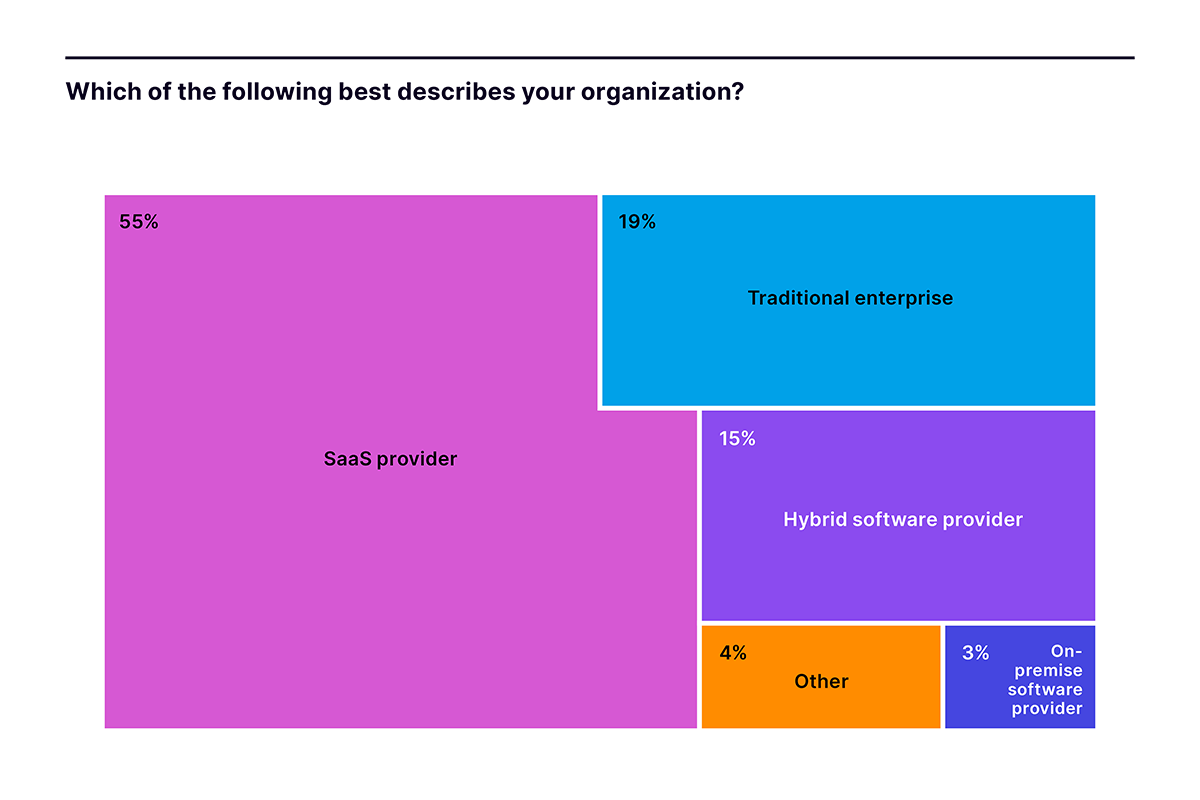

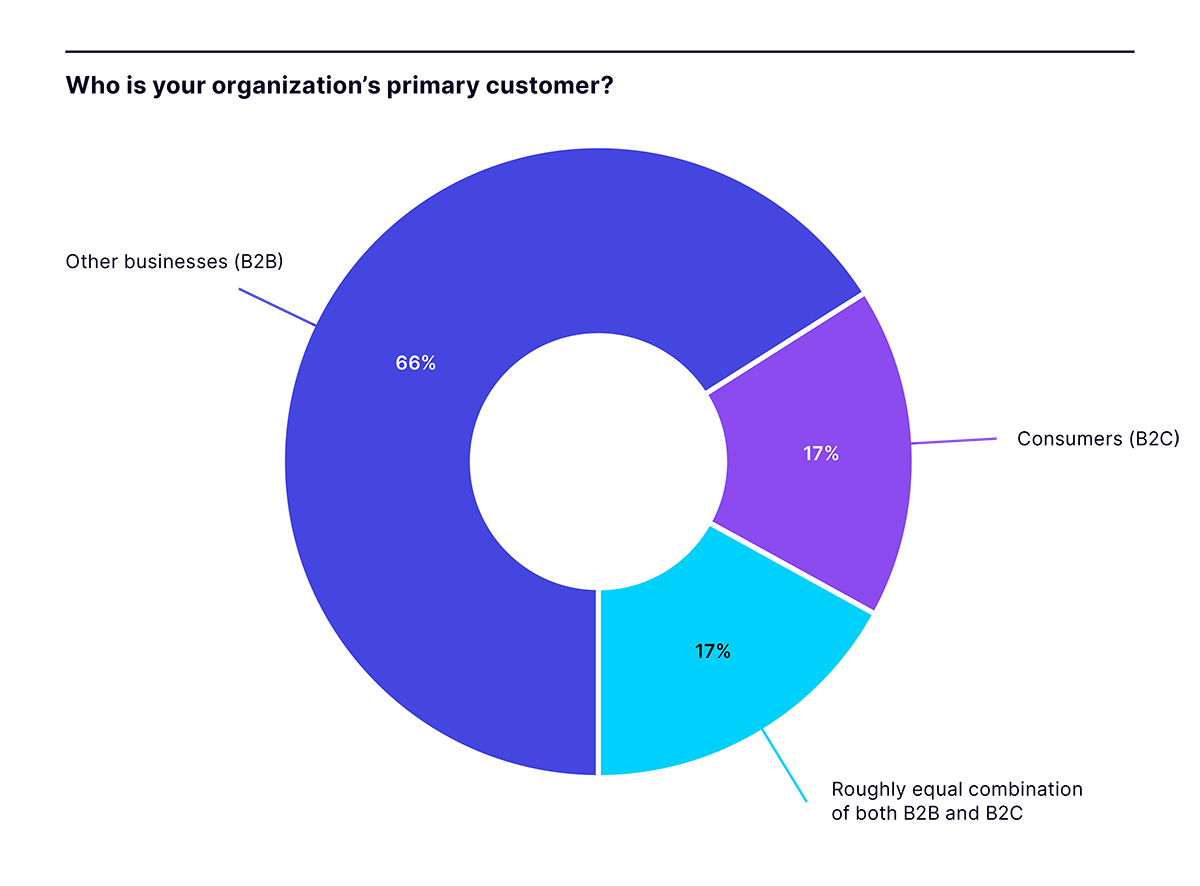

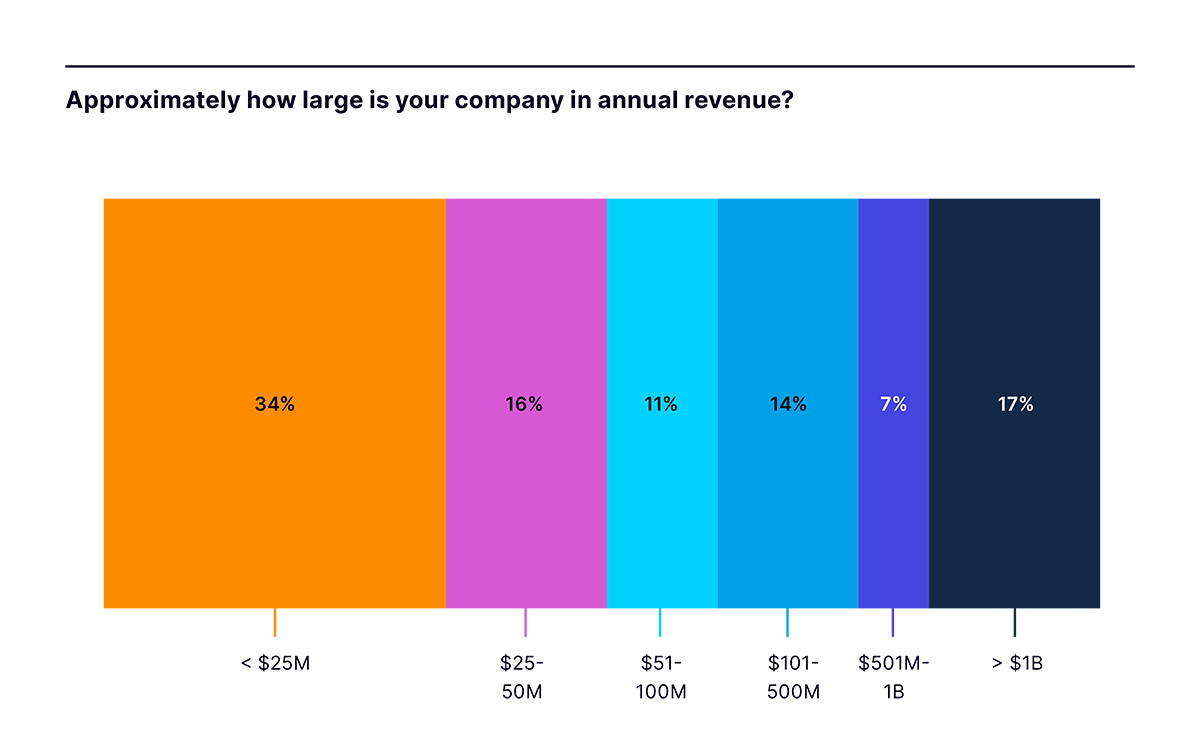

In partnership with Mind the Product, Pendo surveyed 565 product professionals spanning chief product officers to junior product associates. These respondents come from a wide array of industries—including software, financial services, education, and the public sector—and work in both B2B and B2C contexts. Responses were recorded between October 13 and November 7, 2022.

Key findings

Companies are rallying around product to weather the economic storm

An economic downturn has a way of focusing the minds of business leadership. As the stakes become higher and the consequences of disappointing performance starker, companies invest their attention and resources into what they think will generate the best business outcomes. The survey results show that 67% of product leaders say their company has become more focused on product in today’s economic environment, while 62% say the economy has led their company to view their product role as increasingly important.

On first look, this retrenchment around the product may seem counterintuitive. One might assume companies in a downturn would prioritize, say, increasing revenues by boosting sales. But taking a step back, it makes sense. At best, driving a big sales effort will give organizations only a short-term boost. In contrast, companies that invest in R&D during a downturn are investing in the long term. And what better place to invest than in product? In today’s world, after all, your product is so much more than the core services and functions it provides to users. It’s your primary channel for sales and marketing. It’s where customer support happens. It’s how you communicate your brand vision.

Perhaps most important, your product is a treasure trove of data about your customers that can answer important strategic and tactical questions—for example, clear indications of which accounts are at risk of churning and in need of extra support. 61% of respondents said that new business decisions being made possible by product data is a trend that will influence how their organization approaches product management. In other words, companies are leveraging data-driven insights to take the right actions, and recognize product’s importance to the process.

Product people feel supported and empowered in their roles—but worry about staffing shortages slowing them down

The growing importance of product in today’s businesses is also reflected in how product people feel about their work and how their organizations perceive it.

Let’s take a step back. Before the economic slowdown, the business press devoted much coverage to the “Great Resignation” —people leaving their jobs in record numbers to seek new and better opportunities. As the economic slowdown set in, coverage shifted to “quiet quitting”—putting in only the minimum amount of work necessary to one’s role and having no personal investment in the greater vision it’s tied to.

Looking at the survey results, however, it’s clear that these trends don’t extend to product teams. Asked if today’s economy had led them to “quiet quit,” 74% of respondents said they had not—and it’s not hard to see why. Product people feel empowered: 73% agreed that their team is empowered to drive product direction. What’s more, 70% of respondents said the way their company spoke about its commitment to product in public aligned with the reality of their work. In other words, companies aren’t just talking the talk.

At the same time, employees organization-wide are feeling the effects of the economic downturn, and product teams are no exception. Asked to identify their biggest challenge, the most common answer (60%) was lack of personnel resources. Recognizing the increasingly important role they play, product teams want to ensure they’re equipped with the staff necessary to rise to the occasion.

The economy is driving companies to embrace product-led growth (PLG)

Freemium models. Targeted cross-sell and upsell opportunities. Self-guided tours. In-app promotions and ad campaigns. These are just a few examples of the ways in which companies drive product-led growth, a model that’s growing in popularity as companies become forced to do more with fewer resources and staff in today’s economy.

Leveraging the product across all stages of the buyer journey was already becoming more common prior to the downturn. But the need to drive more revenue without driving up costs is accelerating the trend. In addition to the 29% who said their company had introduced PLG strategies prior to the downturn, another 54% of respondents said their organization had either implemented or accelerated implementation of PLG during the downturn.

These results fit a pattern that other observers have taken note of. In a recent report, Gartner estimated that 95% of software as a service (SaaS) companies would employ a self-service PLG go-to-market strategy for acquiring new customers by 2025 (compared to 40% today). It’s no surprise that the trend seems to be extending across other industries as well.

Conclusion

If there’s one thing to take away from the survey findings, it’s this: The companies who come out of the current economic landscape not only intact, but thriving, will be those that recognize a strong product is the key to strong business performance.

Even before the economic downturn, product was already gaining a position of prominence within and across organizations, as evidenced by the rise of the Chief Product Officer (CPO) and greater investment in product tech. A company’s product is becoming the primary means to engage with and expand opportunities with existing customers, acquire new ones, and automate critical sales, marketing, and support functions.

More than any other area, product is becoming the vehicle to drive growth and strengthen organizational efficiency and resilience.

Download the full report to see more

Want to see the other 8 inefficiency areas we uncovered? Download the full report to keep exploring, and learn how Pendo can help your business operate more efficiently.