Inhaltsverzeichnis

In a rush? Download the PDF for later

Download the E-BookHow financial institutions find and fix the hidden productivity drain of bad software experiences

Introduction

Relationship managers don’t need more tools—they need better experiences with the ones they already use

Across Europe and beyond, banks have steadily invested in advanced banking systems. These tech stacks are designed to make customer engagement more efficient and relationship managers more effective. Yet many of these tools only introduce new layers of complexity.

Instead of creating more time for customers, relationship managers now find themselves wrestling with a host of tech-driven challenges:

- Complex and ever-shifting workflows across multiple systems and apps

- Difficulty maintaining compliance as standards and software evolve, and teams grow

- Disconnected systems that obscure a full understanding of their clients

These challenges couldn’t come at a worse time. When economic uncertainty is high, the pressure to deliver more with less grows. Bankers need to operate at peak efficiency, not fumble with unwieldy banking systems.

The solution is not to abandon technology, of course. But it’s crucial to ensure that your digital investments are truly working for your people. This process is called Software Experience Management (SXM): The practice of understanding, optimising, and improving how users interact with software. It elevates software experience to a strategic and purposeful practice, ensuring that even as it evolves, your software is intuitive and responsive to user needs.

“To meet the needs of future consumers, banks will use technology to anticipate customer needs…By leveraging data and insights to create value, they will align their businesses with customer values in a purposeful way.”

—Alyson Clarke, Principal Analyst, Forrester

This book will show why software investments without SXM frequently fail to deliver ROI. We’ll cover how to fix points of friction, accelerate onboarding, increase productivity, and ensure compliance—all in the software you already have. And ultimately, give productive time back to your client-facing team members.

Read on for all of the above, plus real-world examples of these principles in action.

Software investments are failing to deliver promised value

It’s estimated that, globally, banks spent €569 billion on new technology in 2023. This investment is roughly equivalent to the GDP of Sweden. Spending continues to increase by 9% each year, even while revenue is growing at a 4% rate.

€569 billion

tech spend in 2023Spending increases by 9%, revenue by 4% Year over Year

With this level of spending, you might expect to see substantial gains. But productivity in many countries is decreasing year over year. For example, the UK is fourth in productivity out of the G7 countries, trailing Germany, France, and the US.

It’s clear that technology spend is outpacing the ability to manage and optimise each new tool. Without a clear SXM strategy, technology upgrades can be more taxing than transformative.

Ultimately, this is a business performance issue. It’s responsible for billions in wasted spend and missed opportunities to promote sustainable growth.

How the software solution became its own problem

The number of SaaS applications that businesses use has increased dramatically. Between 2017 and 2022, the average number of apps in use increased eightfold. This trend shows no signs of slowing down.

In parallel, the structure of banking organisations is becoming more complex. In 2024, the UK financial services sector recorded its highest level of mergers and acquisitions activity in more than a decade. Each new merger adds to the software footprint and increases the burden on already stretched teams.

SaaS apps used by organisations have increased

x8

As banking systems multiply, so do inefficiencies. Bankers must acclimate to new interfaces, contact support, and learn to use new tools. All of these activities monopolise time that could be spent with customers.

Relationship managers are meant to be growth drivers, not just order takers and tickers of boxes. Every minute they spend bogged down with unwieldy software is a missed opportunity to add value.

New technology alone fails to increase productivity

To realise the full value of your software investments, teams need to use the software confidently and correctly. But too often, training efforts fall short.

Many banks still rely on outdated models to onboard their teams:

- Training is delivered out of context, often through slides rather than sessions within the software itself

- It follows a one-size-fits-all format that rarely aligns with daily realities

- Sessions are long and passive, requiring hours of focus with little interaction

- Training is a one-time exercise. Everyone is expected to remember all they have been taught with minimal follow-up

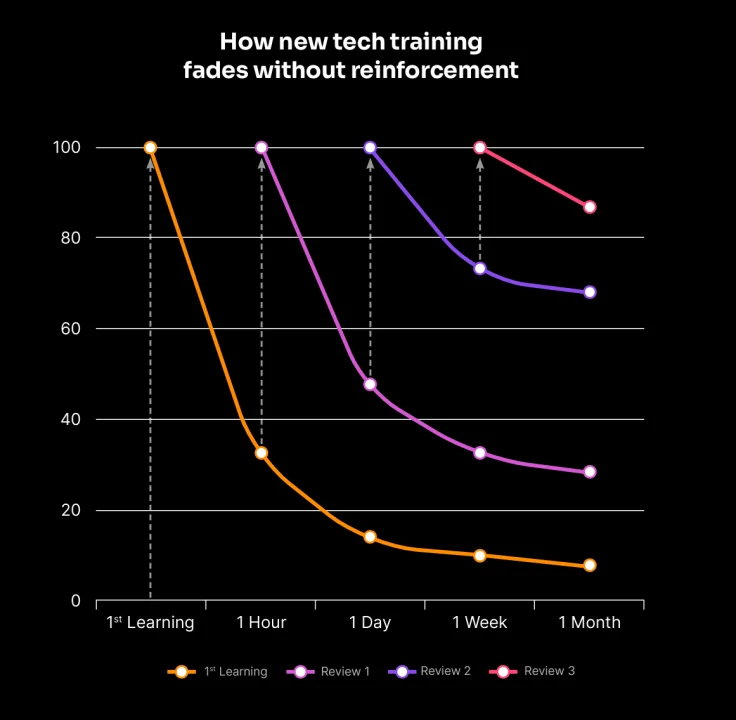

Cognitive science tells us this approach doesn’t promote useful retention of information. A phenomenon called the Curve of Forgetting holds that people forget 70% of new information within 24 hours if they don’t use it right away.

That means most of the effort you put into training vanishes overnight. Without reinforcement or support, your team loses valuable time and struggles to make new tools part of their routine. This creates bottlenecks, increases frustration, and delays return on investment.

Poor software experience leads to lost opportunities and compliance risk

Digital transformation should boost efficiency. But many banks don’t see the results they expect. Analysts estimate that around 70% of digital banking transformation projects fail to meet their targets.

In financial terms, this shortfall is enormous. In 2025, global unrealised returns from digital initiatives could amount to €613 billion. This figure doesn’t include reputational damage, compliance risks, or the cost of demoralised teams.

€613 billion

in unrealised potential

When teams don’t understand or engage with new tools, productivity drops. Upgrades to your banking systems may look impressive on paper, but can backfire if users don’t know how to correctly navigate them. Every missed workflow and delayed process adds to the operational burden.

The risk extends beyond efficiency to compliance. When employees aren’t properly guided through compliance steps, the consequences can be serious. Fines, audit failures, and customer trust erosion are all real threats.

There is no shortage of examples of these unexpected costs:

- Audio electronics company Sonos released a redesigned app in 2024 that was plagued with glitches, leading to an estimated revenue loss of €87,5 million.

- Employee error caused by a confusing user interface cost Citibank €438 million when a creditor refused to return a misdirected payment.

These challenges—both reduced productivity and increased risk—are the direct result of poor software experience.

How to give productive time back to your team

What if your relationship managers could free up time to spend with clients by becoming more productive and efficient in the software you already have?

In order to achieve these goals, banks need to:

- Cut down on hours spent driving software adoption

- Identify bottlenecks and points of friction in banking systems

- Deliver targeted, in-context guidance directly in these systems

- Close the loop with continued analysis, measurement, and optimisation

This is where Software Experience Management (SXM) comes in. SXM is the practice of continuously understanding, optimising, and improving how users interact with software. In a world where the quality of digital experiences determines business success, SXM ensures software is intuitive, responsive, and continuously evolving to meet user needs.

In practice, SXM involves using quantitative, qualitative and visual data together to analyse and improve software experience. It means learning who is getting stuck, where and why they’re encountering trouble, and working to eliminate that friction and continuously improve user experience.

How Pendo works

Pendo is designed to address the entire cycle of software experience evaluation and improvement. It works across any software you’ve built or bought, helping you identify where workflows stall, understand why, and lets you fix them. As a no-code platform, Pendo enables teams to take action quickly. Powered by AI and built with enterprise-grade security and compliance, it helps you drive productivity while maintaining governance.

Hear what’s blocking productivity

With Pendo Listen, you can solicit targeted feedback right in the tools your teams use. Whether it’s a confusing CRM field or a compliance step that’s unclear, employees can flag it in real time.

Pendo AI then triages and synthesises feedback across your systems, surfacing patterns and pinpointing what needs attention.

Spot lost time before it hits your bottom line

Pendo Analytics shows where employees are dropping off, hesitating, or working around inefficient processes. Then, with Pendo Session Replay, you see workflows through their eyes to fully understand the problem.

Make fixes without the wait

Once you know what to improve, you can act without waiting on engineering or third-party software updates.

Use Pendo Guides to:

- Add tooltips to clarify confusing fields

- Highlight compliance steps at the exact moment they’re needed

- Walk employees through complex workflows with step-by-step instructions

These improvements go live in days, not months, and start boosting productivity immediately. You can also augment the in-app communication by sending targeted email sequences, for example tailored by role, team, location, or in-app activity.

Below, we offer real-world examples of this framework in action.

How a global investment firm reduced onboarding time and expenses

A global investment firm needed to migrate 1,200+ newly acquired employees from legacy SFDC to Microsoft D365 across four countries, as part of an M&A related transition.

They needed to minimise the volume of requests to Sales Ops & Delivery support teams as part of migration and help IT application owners customise D365 with confidence.

Pendo Analytics revealed which workflows were not being completed correctly in the transitional period. With these insights in hand, the transition team launched In-app Guides walking through every step. They used Pendo’s built-in targeting to deliver the Guides only to those struggling with completing workflows.

These in-context, in-app interventions reduced support volume and costs while cutting onboarding time for field employees.

How a leading global bank increased productivity

A top-tier institution faced challenges after launching a new CRM system. Bankers were struggling to complete core tasks, but the leadership team lacked visibility into the causes.

Pendo Analytics and Pendo Listen helped identify the key problem areas and identify which specific employees and teams were struggling. Then the bank deployed guides targeted directly to the users who needed the information most. These in-context, targeted interventions helped bankers complete processes more efficiently, saving thousands of hours that can now be redirected to customer engagement.

Pendo makes it easy to see where your bankers are encountering friction in their workflow.

But what makes Pendo unique is the ability to act on this data within the same platform—there’s no need to export your insights into a different system to make them useful.

How a global bank navigated significant regulatory changes

Banks across EMEA face evolving regulatory demands. Whether it’s KYC, MiFID II, or country-specific requirements, staying compliant requires consistent engagement.

When the Canadian government passed a new regulatory requirement, one of the world’s largest financial institutions needed to update internal processes across thousands of users.

They used Pendo to add compliance information directly within their core systems. These prompts showed users how to adjust their workflows and complete each step correctly. The messages reached every relevant user within hours, avoiding weeks of planning, training, and follow-up.

With Pendo, you can reinforce compliance with guides to highlight required fields, enforce workflow steps, or add quick tooltips to explain policy updates. All of this happens inside your existing platforms, without writing code or requesting vendor changes.

Free your relationship managers to focus on what matters most

Banking systems should accelerate productivity, not slow it down. Yet fragmented tools, growing compliance demands, and outdated onboarding processes continue to pull relationship managers away from clients and revenue-generating work.

Pendo changes that. The platform helps banks identify friction points, resolve them fast, and measure the impact. By connecting what employees do, say, and experience, Pendo gives you a complete view of the software journey—so your existing systems work harder for your people, compliance needs, and bottom line.

According to a Forrester Total Economic Impact™, the average enterprise company using Pendo achieves:

- 396% ROI with a six-month time to value

- 50% increase in the speed of software adoption and onboarding

- 80% reduction in support tickets and a 25% lower resolution time

- Over 90,000 employee hours saved, for €1.1 million in increased productivity

Read the full Forrester TEI Report

If you’re ready to realise the full potential of your software investments and your expert team of relationship managers, Pendo can help.

More than 300 banks use Pendo, from Tier 1 global banks to digital-first and regional organisations.

Ready to see Pendo in action? Connect with an expert.